DEF 14A: Definitive proxy statements

Published on April 7, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

AVALONBAY COMMUNITIES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | ||

|

No fee required | |

|

Fee paid previously with preliminary materials | |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

Dear Fellow Stockholders:

We welcome you to join us and the entire Board of Directors at our 2022 Annual Meeting of Stockholders, which will be held at 10:00 a.m. Eastern Daylight Time on May 19, 2022. The meeting will be held in a virtual format via audio webcast only. Stockholders will not be able to attend the Annual Meeting physically but will be able to vote and submit questions online before and during the meeting.

At this year’s meeting we will vote on the election of 12 directors and the ratification of Ernst & Young LLP as the Company’s independent auditor. We will also conduct a non-binding, advisory vote to approve the compensation of the Company’s named executive officers.

The past 18 months have been a time of transition for AvalonBay. Ben joined AvalonBay as President in January 2021, bringing fresh perspectives and talents to the Company from his diverse experiences in the real estate industry. At the beginning of 2022, in accordance with a previously announced transition, Tim retired as Chief Executive Officer and became Executive Chairman, and Ben assumed the additional role of Chief Executive Officer. We both remain committed to fulfilling AvalonBay’s purpose of Creating a Better Way to Live through our core values – a commitment to integrity, a focus on continuous improvement, and a spirit of caring. As an organization, we are energized as we shape the future course of AvalonBay and position the Company for continued growth and success.

Your vote at the upcoming Annual Meeting is important. Whether or not you plan to attend the meeting, we want your shares to be represented. Please authorize a proxy to vote your shares as soon as possible. You can do so on a dedicated website, by telephone, or by completing, signing and returning the proxy card or voting instruction form enclosed with the Proxy Statement (if you received a printed copy of the proxy materials). For more detailed instructions on how to vote and attend the virtual meeting audio webcast, as well as how to submit questions before and during the meeting, see pages 71-73 of the Proxy Statement.

Our Board of Directors values your participation as a stockholder and appreciates your continued support of AvalonBay.

April 7, 2022

Sincerely,

Timothy J. Naughton Executive Chairman of the Board |

Benjamin W. Schall Chief Executive Officer and President |

| AvalonBay Communities | ||

| 2022 PROXY STATEMENT |

|

MAY 19, 2022 10:00 a.m., Eastern Daylight Time |

||

|

NOTICE IS HEREBY GIVEN that the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of AvalonBay Communities, Inc., a Maryland corporation (“AvalonBay”), will be held on Thursday, May 19, 2022, at 10:00 a.m., Eastern Daylight Time, in a virtual format via audio webcast only, for the following purposes: 1.

To elect 12 directors to serve until the 2023 Annual Meeting of Stockholders and until their respective successors are elected and qualify. 2.

To adopt a resolution to approve, on a non-binding, advisory basis, the compensation of certain executives of AvalonBay. 3.

To ratify the selection of Ernst & Young LLP to serve as AvalonBay’s independent auditors for 2022. 4.

To transact such other business as may be properly brought before the Annual Meeting and at any postponements or adjournments thereof. The Board of Directors has fixed the close of business on March 24, 2022, as the record date for determining the stockholders entitled to receive notice of and to vote at the Annual Meeting. Only holders of record of AvalonBay’s common stock on that date will be entitled to receive notice of and to vote at the Annual Meeting and at any postponements or adjournments thereof.

Arlington, Virginia April 7, 2022 By Order of the Board of Directors Edward M. Schulman Corporate Secretary |

The meeting will be held in a virtual format via audio webcast only. You will not be able to attend the Annual Meeting physically, but you can attend online and vote and submit questions online before and during the meeting. The Annual Meeting can be accessed via AvalonBay’s Annual Meeting website at www.virtualshareholdermeeting.com/AVB2022 beginning 15 minutes prior to the scheduled start time of 10:00 a.m., Eastern Daylight Time. You will need the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, proxy card or voting instruction form. Technical support will be available by telephone beginning when the registration window opens and throughout the Annual Meeting.

To ensure access, all validated stockholders may submit questions in advance, beginning on April 7, 2022, by visiting www.proxyvote.com. Questions will be accepted on the Annual Meeting website, www.virtualshareholdermeeting.com/AVB2022, during the meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 19, 2022: The Notice of Annual Meeting, Proxy Statement, Annual Report to Stockholders and Annual Report on Form 10-K for the year ended December 31, 2021, are available at www.proxyvote.com. This Proxy Statement and the accompanying Notice of Annual Meeting and proxy card are first being made available to stockholders on or about April 7, 2022. |

Holders of record of AvalonBay common stock may vote during the meeting. However, we suggest that you authorize a proxy to vote |

||

BY INTERNET |

BY TELEPHONE |

BY MAIL |

|

Go to |

Call 800-690-6903 |

Sign the enclosed proxy card |

|

For more information on how to vote, see “Some Questions You May Have Regarding This Proxy Statement.” |

||

| AvalonBay Communities | 3 | |

| 2022 PROXY STATEMENT |

Proxy Summary

This summary highlights certain information about AvalonBay Communities, Inc., a Maryland corporation (“AvalonBay” or the “Company”), and its 2022 Annual Meeting of Stockholders and summarizes information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider. Please read the entire Proxy Statement before voting. This Proxy Statement and the accompanying Notice of Annual Meeting and proxy card are first being made available to stockholders on or about April 7, 2022. For more complete information regarding AvalonBay’s 2021 performance, please review the Annual Report on Form 10-K for the year ended December 31, 2021, and the 2021 Annual Report to Stockholders, both of which are available online at www.proxyvote.com and on our website at www.avalonbay.com/investors.

2022 Annual Meeting of Stockholders Information

Date and Time: |

Virtual Meeting Site: |

Record Date: |

|

Thursday, May 19, 2022, at 10:00 a.m., Eastern Daylight Time |

www.virtualshareholdermeeting.com/ |

March 24, 2022 |

Meeting Agenda and Voting Matters

|

Proposal |

Board’s voting |

Where to find more |

|

1.

Election of Directors |

FOR EACH NOMINEE |

pp 8-15 |

|

2.

Non-Binding, Advisory Vote to Approve Executive Compensation |

FOR |

pp 26-52 |

|

3.

Ratification of Selection of Independent Auditor |

FOR |

pp 68-69 |

| AvalonBay Communities | 4 | |

| 2022 PROXY STATEMENT |

Election of Directors

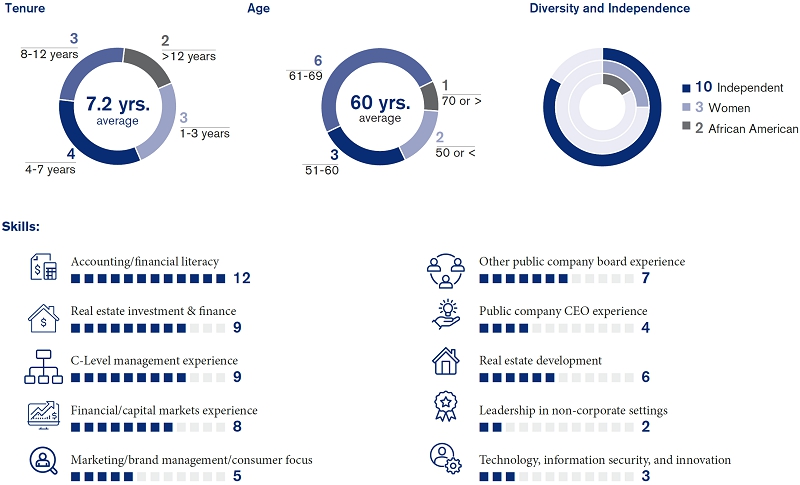

Our Board represents a broad range of ages, tenures, and experience, as shown below.

|

Name |

Age |

Director Since |

Independent |

Committees* |

|

Glyn F. Aeppel |

63 |

2013 |

|

IFC, NGCR |

|

Terry S. Brown |

60 |

2015 |

|

IFC (Chair), NGCR |

|

Alan B. Buckelew |

73 |

2011 |

|

AC, CC |

|

Ronald L. Havner, Jr. |

64 |

2014 |

|

AC (Chair), IFC |

|

Stephen P. Hills |

63 |

2017 |

|

CC, IFC |

|

Christopher B. Howard |

53 |

2021 |

|

AC, IFC |

|

Richard J. Lieb |

62 |

2016 |

|

AC, CC (Chair) |

|

Nnenna Lynch |

50 |

2021 |

|

AC, IFC |

|

Timothy J. Naughton** |

60 |

2005 |

|

IFC |

|

Benjamin W. Schall |

47 |

2021 |

|

IFC |

|

Susan Swanezy |

63 |

2016 |

|

NGCR (Chair), IFC |

|

W. Edward Walter*** |

66 |

2008 |

|

CC, NGCR |

|

*

IFC = Investment and Finance Committee, AC = Audit Committee, CC = Compensation Committee, NGCR = Nominating, Governance and Corporate Responsibility Committee. **

Mr. Naughton is the Executive Chairman of the Board ***

Mr. Walter is the Lead Independent Director |

||||

| AvalonBay Communities | 5 | |

| 2022 PROXY STATEMENT |

Corporate Governance and ESG Best Practices

|

Commitment to Board refreshment, including guidelines on director and committee chairman tenure |

|

No stockholder rights plan (“poison pill”) and policy regarding adoption of future plans |

|

Annual Board, committee and director evaluations |

|

Double-trigger equity compensation vesting in the event of a change in control |

|

Annual election of all directors with a majority voting standard in uncontested elections |

|

Policy on political contributions and government relations publicly available on website |

|

Lead Independent Director |

|

Directors encouraged to attend continuing education programs |

|

Independent Audit, Compensation and Nominating, Governance and Corporate Responsibility Committees |

|

Published a comprehensive sustainability and corporate social responsibility report every year for the past decade |

|

Regular executive sessions of independent directors, including at each regularly scheduled Board meeting |

|

Annual advisory vote to ratify independent auditor |

|

Director and senior officer stock ownership guidelines |

|

Annual advisory vote on executive compensation |

|

Robust anti-hedging, anti-speculation and no pledging policies |

|

Published diversity objectives |

|

Policy regarding stockholder approval of certain future severance agreements |

|

Published EEO-1 data |

|

Bylaws contain provisions for stockholder rights relating to proxy access and Bylaw amendments |

|

Published energy management and other ESG goals and regular reporting to Board and NGCR Committee |

|

Policy on recoupment of incentive compensation (clawback policy) |

|

Board Audit Committee oversight of cybersecurity meetings and regular meetings with senior IT associates |

| AvalonBay Communities | 6 | |

| 2022 PROXY STATEMENT |

Executive Compensation Highlights

|

AvalonBay’s compensation program is designed to: |

|||

|

1.

Attract, retain, and motivate talent |

2.

Align the interests |

3.

Direct performance |

4.

Ensure that compensation is aligned with performance |

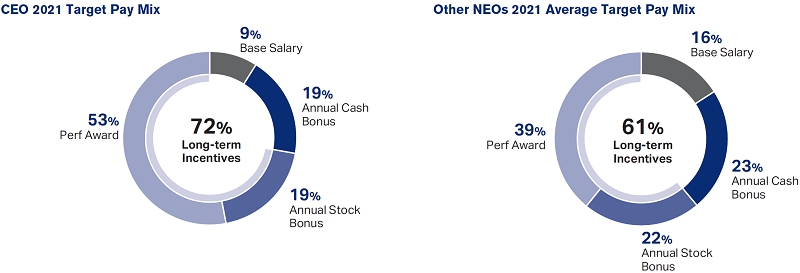

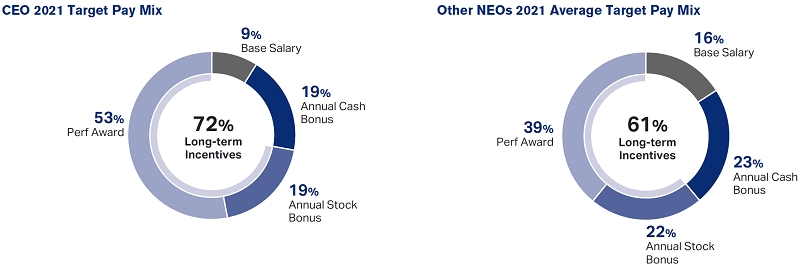

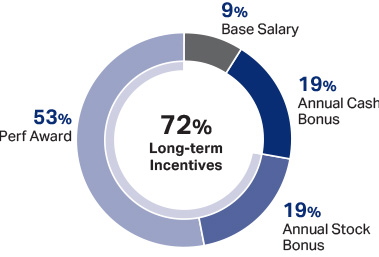

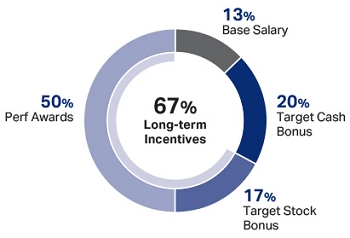

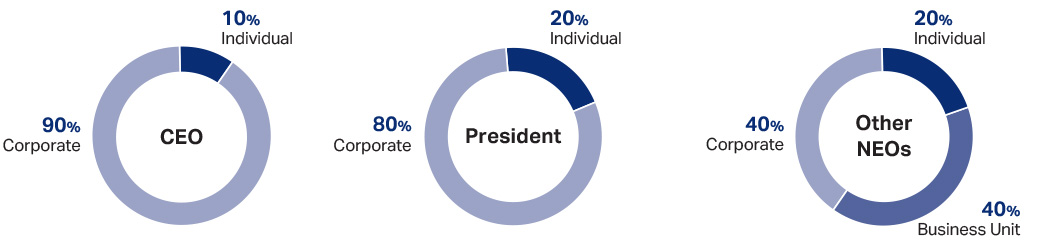

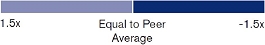

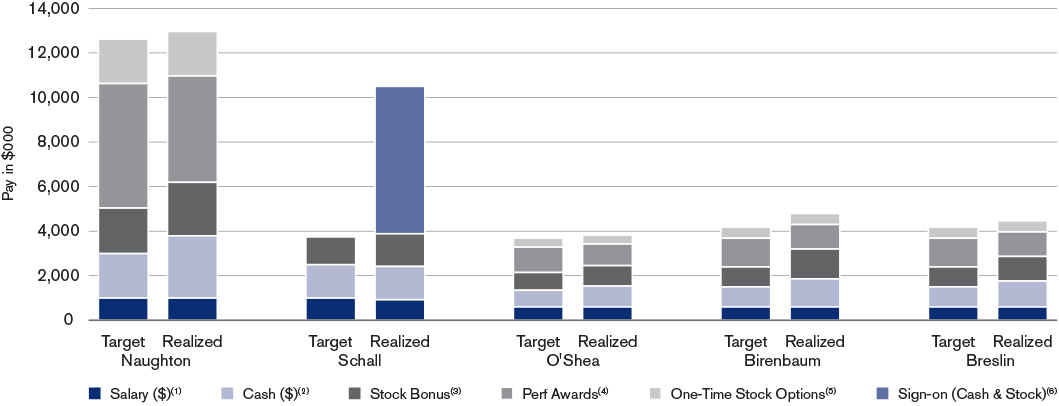

Consistent with our total compensation philosophy, a substantial majority of the target pay for our NEOs is variable and contingent on performance.

Target Total Compensation Mix*

*Does not include the non-routine supplemental stock option grants made in February 2021. See discussion on p. 47.

| AvalonBay Communities | 7 | |

| 2022 PROXY STATEMENT |

Proposal 1. Election of Directors

The Board of Directors (which we refer to as the “Board”) currently consists of 12 members. All of the current directors are nominated for re-election at the Annual Meeting and if elected will serve until the 2023 Annual Meeting of Stockholders and until their successors are elected and qualify. The Board anticipates that each of the nominees, if elected, will serve as a director. However, if any nominee is unable to serve or chooses not to serve, proxies will be voted for the election of such other person as the Board may recommend. You may not vote for more than 12 directors at the Annual Meeting.

Required Vote and Recommendation

Only holders of record of AvalonBay’s common stock as of the close of business on the Record Date are entitled to vote on this proposal. Proxies will be voted for all of the nominees unless contrary instructions are set forth on a properly executed proxy card. Under our Bylaws, a majority of the total votes cast as to each nominee is required to elect such nominee. Under Maryland law, abstentions and broker non-votes are not treated as votes cast, and will have no effect on the result of the vote.

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR ALL OF THE NOMINEES. |

| AvalonBay Communities | 8 | |

| 2022 PROXY STATEMENT |

The Nominating, Governance and Corporate Responsibility Committee and the full Board are focused on ensuring that the composition of the Board continues to provide the diversity of background, experience, functional skills, expertise, and thought necessary to appropriately address the needs of AvalonBay and our stockholders.

The following table summarizes certain qualifications, skills and experiences of each director that the Board considered important in its decision to re-nominate that individual to the Board. Exclusion of a factor for a nominee does not necessarily mean the nominee does not possess that attribute. It means only that when the Nominating, Governance and Corporate Responsibility Committee considered skills and experiences in the overall context of the members of the Board of Directors, certain attributes were not considered critical with respect to certain individuals.

|

Skills, attribute or experience |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounting/Financial Literacy |

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate Development |

|

|

|

|

|

|

|

|

|

|

|

|

|

Board Diversity* |

|

|

|

|

|

|

|

|

|

|

|

|

|

C-Level Management Experience |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial/Capital Markets Experience |

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing/Brand Management/Consumer Focus |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-AVB Public Board Experience |

|

|

|

|

|

|

|

|

|

|

|

|

|

Public Company CEO Experience |

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate Investment & Finance |

|

|

|

|

|

|

|

|

|

|

|

|

|

Leadership in Non-Corporate Settings |

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology, Information Security and Innovation |

|

|

|

|

|

|

|

|

|

|

|

|

|

*

Representation of gender or ethnic perspectives that expand the Board’s understanding of the needs and viewpoints of our prospective residents, residents, associates, and other stakeholders. The following directors have self-identified as female: Glyn Aeppel, Nnenna Lynch and Susan Swanezy. The following directors have self-identified as Black or African American: Christopher Howard and Nnenna Lynch. |

|||||||||||||

The biographies below describe each director’s qualifications and relevant experience in more detail.

| AvalonBay Communities | 9 | |

| 2022 PROXY STATEMENT |

Director Nominees

Glyn F. Aeppel |

AvalonBay committees: |

Other public company boards: |

|

|

Age: 63 Director since: 2013 Independent |

Investment and Finance Nominating, Governance and Corporate Responsibility Director Skills and Experiences

|

•

Simon Property Group, Inc. (since 2016) |

|

|

Professional background Ms. Aeppel has more than 30 years of experience in property acquisitions, development and financing. She established a hotel investment and advisory company, Glencove Capital, in 2010, and serves as its President and Chief Executive Officer. From 2008 to 2010, Ms. Aeppel served as Chief Investment Officer of Andre Balazs Properties, an owner, developer and operator of luxury hotels. From 2006 to 2008, she served as Executive Vice President of Acquisitions and Development for Loews Hotels and as a member of its Executive Committee. From 2004 to 2006, she was a principal of Aeppel and Associates, a hospitality advisory development company, during which time she assisted Fairmont Hotels and Resorts in expanding in the United States and Europe. Earlier in her career, Ms. Aeppel held executive positions with Le Meridien Hotels, Interstate Hotels and Resorts, Inc., FFC Hospitality, LLC, Holiday Inn Worldwide and Marriott Corporation.

Other affiliations Ms. Aeppel serves on the boards of three private companies: Exclusive Resorts, Gilbane, Inc. and Concord Hospitality Enterprises.

Education B.A., Honors, Principia College Master of Business Administration, Harvard Business School |

|||

Terry S. Brown |

AvalonBay committees: |

Other public company boards: |

|

|

Age: 60 Director since: 2015 Independent |

Investment and Finance (Chair) Nominating, Governance and Corporate Responsibility Director Skills and Experiences

|

•

None currently |

|

|

Professional background Mr. Brown is a Co-founder and Managing Partner of Asana Partners, a private real estate investment company, which he helped found in 2015. Prior to that he was Chairman and Chief Executive Officer of EDENS, one of the country’s leading private owners, operators and developers of retail real estate. Mr. Brown joined EDENS as its Chief Executive Officer in 2002 after serving as Chief Executive Officer of Anderson Corporate Finance LLC (a NASD broker-dealer subsidiary of Arthur Andersen LLP), where he was responsible for strategy and investment banking activities on a global basis across the real estate, manufacturing, technology, services and energy industries.

Education Bachelor of Business Administration, University of Georgia, summa cum laude |

|||

| AvalonBay Communities | 10 | |

| 2022 PROXY STATEMENT |

Alan B. Buckelew |

AvalonBay committees: |

Other public company boards: |

|

|

Age: 73 Director since: 2011 Independent |

Audit Compensation Director Skills and Experiences

|

•

None currently |

|

|

Professional background Mr. Buckelew retired in December 2018 after serving two years as Chief Information Officer of Carnival Corporation, a publicly traded cruise line holding company. From 2013 to 2016 he served as Carnival’s Chief Operating Officer. Prior to that he was President of Princess Cruises, Inc. from 2004 to 2013, overseeing brand and operations. During this time period, Mr. Buckelew also served as Chief Operating Officer for Cunard Cruise Line from 2004 to 2007. Earlier in his career, Mr. Buckelew served for four years as Executive Vice President of Corporate Services and Chief Financial Officer for Princess Cruises, with responsibility for the company’s strategic planning, marketing and yield management functions.

Other affiliations Mr. Buckelew is a director of the Vietnam Veterans Memorial Fund.

Education B.A. and Master of Business Administration, University of California, Los Angeles |

|||

Ronald L. Havner, Jr. |

AvalonBay committees: |

Other public company boards: |

|

|

Age: 64 Director since: 2014 Independent |

Audit (Chair) Investment and Finance Director Skills and Experiences

|

•

Public Storage (since 2002) •

PS Business Parks, Inc. (since 1998) •

Shurgard Self-Storage, SA (since 2018) |

|

|

Professional background Mr. Havner serves as the non-executive Chairman of the Board of Public Storage, a publicly traded self-storage facility real estate investment trust. Mr. Havner was the Chief Executive Officer of Public Storage for 16 years, until he retired from that role in 2018, and he has served as Chairman of Public Storage since 2011. Mr. Havner also serves as the non-executive Chairman of the Board of PS Business Parks, Inc. and Shurgard Self-Storage, SA.

Other affiliations Mr. Havner is a previous Chairman of the Board of Governors of the National Association of Real Estate Investment Trusts (“Nareit”).

Education B.A. in Economics, University of California, Los Angeles |

|||

| AvalonBay Communities | 11 | |

| 2022 PROXY STATEMENT |

Stephen P. Hills |

AvalonBay committees: |

Other public company boards: |

|

|

Age: 63 Director since: 2017 Independent |

Compensation Investment and Finance Director Skills and Experience

|

•

None currently |

|

|

Professional background Mr. Hills joined the Georgetown University Law Center in 2016 as the Founding Director of the law school’s Business Law Scholars Program. Prior to joining Georgetown Law, Mr. Hills worked for 28 years with the Washington Post, where he had served since 2002 as President and General Manager.

Education B.A., Yale University Master of Business Administration, Harvard Business School |

|||

Christopher B. Howard |

AvalonBay committees: |

Other public company boards: |

|

|

Age: 53 Director since: 2021 Independent |

Audit Investment and Finance Director Skills and Experience

|

•

None currently |

|

|

Professional background Dr. Howard became the Executive Vice President and Chief Operating Officer of the Arizona State University Public Enterprise in February 2022. Prior to that he served as the President of Robert Morris University (PA) since 2016. Before he was appointed to that position, Dr. Howard had been, since 2010, the president of Hampden-Sydney College and, before that, he served as vice president for leadership and strategic initiatives at the University of Oklahoma. Dr. Howard’s experience includes service in the military (he earned a Bronze Star for his service in Afghanistan in 2003) and in the private sector (he worked in a variety of capacities at both General Electric and Bristol-Myers Squibb).

Other affiliations Dr. Howard serves and has served as a board member or trustee of a number of non-profits, including organizations focused on education and career advancement for military personnel and underprivileged youth.

Education Distinguished Graduate of the U.S. Air Force Academy D.Phil in Politics, University of Oxford, Rhodes Scholar Master of Business Administration, Harvard Business School, with Distinction |

|||

| AvalonBay Communities | 12 | |

| 2022 PROXY STATEMENT |

Richard J. Lieb |

AvalonBay committees: |

Other public company boards: |

|

|

Age: 62 Director since: 2016 Independent |

Audit Compensation (Chair) Director Skills and Experience

|

•

Orion Office REIT (since 2021) •

iStar, Inc. (since 2019) |

|

|

Professional background Mr. Lieb is a Senior Advisor at Greenhill & Co., LLC, a publicly traded investment bank. Prior to that he was a Managing Director and Chairman of Real Estate at Greenhill. Mr. Lieb previously held a variety of senior positions at Greenhill, including head of the Real Estate, Gaming and Lodging Group for over ten years and Chief Financial Officer for over four years. Prior to joining Greenhill in 2005, Mr. Lieb spent more than 20 years with Goldman, Sachs & Co., where he headed the Real Estate Investment Banking Department from 2000 to 2005. Mr. Lieb previously served as a director of CBL and Associates Properties from February 2016 until November 2021, and as a director of Vereit, Inc. from February 2017 until November 2021.

Education B.A., Wesleyan University Master of Business Administration, Harvard Business School |

|||

Nnenna Lynch |

AvalonBay committees: |

Other public company boards: |

|

|

Age: 50 Director since: 2021 Independent |

Audit Investment and Finance Director Skills and Experience

|

•

Blackstone Mortgage Trust, Inc. (since 2021) |

|

|

Professional background Ms. Lynch founded Xylem Projects, a real estate development venture focused on creating mixed-use projects that serve residents and neighborhoods, in 2018, and serves as Xylem’s Chief Executive Officer. Prior to founding Xylem Projects, Ms. Lynch was Head of Development at The Georgetown Company, a real estate investment and development company that she joined in 2014. Earlier in her career, Ms. Lynch served for six years as a Senior Policy Advisor in the Bloomberg mayoral administration in New York City where, among other duties, she led initiatives that resulted in the redevelopment and construction of new housing and commercial space. In both the private sector and as a public employee, Ms. Lynch helped to plan and create affordable housing in New York City.

Other affiliations Ms. Lynch serves as a board member or trustee of a number of non-profits, including the Van Alen Institute, which focuses on helping create equitable cities through inclusive design. She also serves on the Board of Trustees of Villanova University.

Education B.A., Villanova University Master’s degree in Social Anthropology, University of Oxford, Rhodes Scholar |

|||

| AvalonBay Communities | 13 | |

| 2022 PROXY STATEMENT |

Timothy J. Naughton |

AvalonBay committees: |

Other public company boards: |

|

|

Age: 60 Director since: 2005 Executive Chairman |

Investment and Finance Director Skills and Experience

|

•

Park Hotels and Resorts, Inc. (since 2017) |

|

|

Professional background Mr. Naughton is AvalonBay’s Executive Chairman of the Board. He served as Chief Executive Officer from 2012 through January 3, 2022, and served as President from 2005 until January 2021. Mr. Naughton has served as Chairman of the Board since 2013. Mr. Naughton’s prior roles at AvalonBay included Chief Operating Officer, Chief Investment Officer, and Regional Vice President – Development and Acquisitions. Mr. Naughton has been with AvalonBay and its predecessors since 1989. Mr. Naughton previously served as a director of Welltower, Inc. from 2013 until 2019.

Other affiliations Mr. Naughton is a former Chairman of Nareit, a member of The Real Estate Round Table, a member and past chairman of the Multifamily Council of the Urban Land Institute (“ULI”), and a member of the Real Estate Forum. He sits on the board of the Jefferson Scholars Foundation at the University of Virginia.

Education B.A., University of Virginia, Phi Beta Kappa Master of Business Administration, Harvard Business School |

|||

Benjamin W. Schall |

AvalonBay committees: |

Other public company boards: |

|

|

Age: 47 Director since: 2021 Chief Executive Officer |

Investment and Finance Director Skills and Experience

|

•

None currently |

|

|

Professional background Mr. Schall joined AvalonBay as President and a director in January 2021, and became Chief Executive Officer effective January 3, 2022. Before joining AvalonBay, Mr. Schall was the Chief Executive Officer and President and a trustee of Seritage Growth Properties, a publicly traded real estate investment trust principally engaged in owning, developing and managing a diversified portfolio of retail and mixed-use properties throughout the United States. Earlier in his career, Mr. Schall served as Chief Operating Officer of Rouse Properties, Inc., a publicly traded mall and retail REIT (since acquired) from 2012 to 2015, and as Senior Vice President of Vornado Realty Trust, a publicly traded REIT that owns, manages and develops office and retail assets, before that.

Other affiliations Mr. Schall is a member of the Advisory Board of Governors of Nareit, an Executive Committee member of the National Multifamily Housing Council (“NMHC”), a member of the Real Estate Roundtable and a Trustee of the International Council of Shopping Centers (“ICSC”). He serves as Co-Chair of the Board of University Settlement, a non-profit service provider in New York City.

Education B.A., Swarthmore College Master of Business Administration, Harvard Business School |

|||

| AvalonBay Communities | 14 | |

| 2022 PROXY STATEMENT |

Susan Swanezy |

AvalonBay committees: |

Other public company boards: |

|

|

Age: 63 Director since: 2016 Independent |

Nominating, Governance and Corporate Responsibility (Chair) Investment and Finance Director Skills and Experience

|

•

None currently |

|

|

Professional background Since 2010, Ms. Swanezy has been a partner at Hodes Weill & Associates L.P., a global advisory firm focused on the real estate investment management industry. Previously, Ms. Swanezy served as Managing Director, Global Head of Capital Raising for Real Estate Products at Credit Suisse Group AG. She also held a variety of positions at Deutsche Bank AG and its affiliates, including Partner and Managing Director – Client Relations for RREEF, the real estate investment management business of Deutsche Bank’s Asset Management division. In addition to her real estate experience, Ms. Swanezy brings a deep network of relationships and knowledge of both the public and private capital markets.

Education B.S., Georgetown University School of Foreign Service |

|||

W. Edward Walter |

AvalonBay committees: |

Other public company boards: |

|

|

Age: 66 Director since: 2008 Lead Independent Director since: 2019 |

Compensation Nominating, Governance and Corporate Responsibility Director Skills and Experience

|

•

Ameriprise Financial, Inc. (since 2018) •

Claros Mortgage Trust, Inc. (since 2021) |

|

|

Professional background Mr. Walter has served as the Global Chief Executive Officer for the ULI since 2018. Prior to that he was the Robert and Lauren Steers Chair in Real Estate at the Steers Center for Global Real Estate at Georgetown University’s McDonough School of Business, where he continues to serve as an adjunct professor. He was President and Chief Executive Officer of Host Hotels and Resorts, Inc. (“Host”), a publicly traded premier lodging real estate company, from 2007 through 2016. Before assuming that role, he held several other senior positions at Host beginning in 1996, including four years as Executive Vice President and Chief Financial Officer and two years as Chief Operating Officer.

Other affiliations Mr. Walter is past Chairman of Nareit, past Chairman of the Federal City Council, and a member of the Board of Visitors of the Georgetown University Law Center.

Education B.A., Colgate University J.D., Georgetown University Law Center |

|||

| AvalonBay Communities | 15 | |

| 2022 PROXY STATEMENT |

Corporate Governance

Independence of the Board

The New York Stock Exchange (“NYSE”) has adopted independence standards for companies listed on the NYSE, which apply to AvalonBay. These standards require a majority of the Board of Directors to be independent and every member of the Audit Committee, Compensation Committee and Nominating, Governance and Corporate Responsibility Committee to be independent. NYSE standards provide that a director is considered independent only if the Board of Directors “affirmatively determines that the director has no material relationship with the listed company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the company).” In addition, the NYSE prescribes certain other “independence” standards.

To determine which of its members is independent, the Board of Directors uses the standards prescribed by the NYSE and also considers whether a director had any other past or present relationships with AvalonBay that created conflicts or the appearance of conflicts. Based on its most recent review, the Board determined that all nominees for director are independent, except for Mr. Naughton and Mr. Schall.

NYSE rules provide for additional independence standards that apply to members of the Audit Committee and the Compensation Committee. The Board has determined that each current and proposed member of these committees satisfies these additional standards.

Leadership Structure and Lead Independent Director

Timothy J. Naughton served as AvalonBay’s Chairman of the Board and Chief Executive Officer during 2021. He retired as Chief Executive Officer effective January 3, 2022, and Mr. Schall assumed that role, reporting directly to the Board of Directors. Mr. Naughton continues to serve on the Board and as an officer of AvalonBay as Executive Chair.

The Board believes that having Mr. Naughton serve as the Executive Chairman while Mr. Schall takes over the role of Chief Executive Officer ensures a smooth transition of leadership, consistent with AvalonBay’s 25-year history of continuity of strategy and leadership. Having Mr. Naughton serve as Executive Chairman enables Mr. Naughton to act as a bridge between management and the Board, helping both groups to act with common purpose.

To help ensure sound corporate governance practices, the Board of Directors established the position of Lead Independent Director. Mr. Walter has served as the Lead Independent Director since May 2019. The Lead Independent Director presides at all meetings of the Board of Directors at which the Chairman is not present, serves as a liaison between the Chairman of the Board and the Chief Executive Officer, on the one hand, and the independent directors, on the other, establishes and approves meeting agendas for the Board, has the authority to call meetings of the independent directors, confers with the Chairman of the Board and the Chief Executive Officer regularly, and acts as a contact person for stockholders and others who wish to communicate with the independent directors.

Succession Planning and Board Refreshment

The Board considers a variety of factors when choosing candidates for Board appointment or nomination. While we value long-tenured directors who know AvalonBay and management well, the Board also believes it is important to ensure there are occasional vacancies that create opportunities for new directors who may bring different or more recent experiences or expertise to the Board. Consistent with this philosophy, we have recruited three new independent directors to join the Board in the past five years.

AvalonBay’s Corporate Governance Guidelines incorporate term expectations that reflect the Board’s view of the importance of succession planning. Specifically, the Corporate Governance Guidelines express an expectation that (i) an independent director will not be re-nominated after completing 12 full years of service or within the several years that follow; (ii) the Lead Independent Director will serve in that role for approximately three to five years; and (iii) committee chairs will serve for three to five years. In each case, the guideline is flexible and the exact timing for any transition will depend on the needs of the Board at the time and whether an appropriate successor has been identified and nominated.

| AvalonBay Communities | 16 | |

| 2022 PROXY STATEMENT |

Evaluation and Nomination of Director Candidates

One of the key functions of the Nominating, Governance and Corporate Responsibility Committee is identifying and nominating candidates for service on the Board. In this regard, the Nominating, Governance and Corporate Responsibility Committee considers the factors set forth in the Corporate Governance Guidelines, which include the nominee’s business and professional background; history of leadership or contributions to other organizations; functional skill set and expertise; general understanding of marketing, finance, accounting and other elements relevant to the success of a publicly-traded company; and service on other boards of directors. Given the current business, opportunities and challenges confronting our industry, the Nominating, Governance and Corporate Responsibility Committee pays particular attention to the skills and experience described in the Director Skills/Experience Matrix provided above.

When recommending a slate of nominees for director and identifying new candidates for service, the Nominating, Governance and Corporate Responsibility Committee considers whether the Board as a whole has and will continue to have an adequate distribution and representation of relevant skills, backgrounds and experience. In addition to professional history and expertise, the Board may consider diversity of background, experience and thought in evaluating and recommending candidates for election. The Board believes that diversity (including diversity of gender, race and ethnicity) is important because a variety of points of view can contribute to a more effective decision-making process.

The Nominating, Governance and Corporate Responsibility Committee may employ a variety of methods for identifying and evaluating nominees for director. In considering whether to recommend re-nomination of a current director for another term, the Nominating, Governance and Corporate Responsibility Committee considers whether the skills, commitment and performance of the individual director are such that the individual’s continued service on the Board is desirable. The Nominating, Governance and Corporate Responsibility Committee also may assess the size of the Board, the need for particular expertise, and whether any vacancies are expected, due to retirement or otherwise.

The Nominating, Governance and Corporate Responsibility Committee will consider potential candidates for director who come to the committee’s attention through current Board members, professional search firms, stockholders or other sources. When compiling a pool of candidates to review and interview for a new director search, the Nominating, Governance and Corporate Responsibility Committee endeavors to include, and requests that any search firm it engages endeavor to include, candidates with a diversity of race, ethnicity and gender. AvalonBay has in the past and may in the future engage a third party firm to help identify and/or evaluate potential director nominees.

Nominees Recommended by Stockholders

The Nominating, Governance and Corporate Responsibility Committee will consider candidates properly recommended by stockholders using the same criteria that apply to candidates from other sources. Following verification of the stockholder status of the party or parties proposing a candidate, the Nominating, Governance and Corporate Responsibility Committee makes an initial analysis of the candidate’s qualifications based on the criteria summarized above to determine whether the candidate is suitable for service on the Board of Directors before deciding whether to undertake a complete evaluation of the candidate. If a stockholder provides any materials in connection with the nomination of a director candidate, such materials are forwarded to the Nominating, Governance and Corporate Responsibility Committee as part of its review. The Board may also consider the specific information required to be provided by nominating stockholders pursuant to the requirements of AvalonBay’s Bylaws. Stockholders may also nominate directors in accordance with the proxy access provisions of AvalonBay’s Bylaws. For more information on stockholder nominations, see “Other Matters - Stockholder Nominations for Directors and Proposals for the Annual Meeting.”

Board of Directors Risk Oversight

We have a number of practices with regard to Board oversight of risk management matters. The charter of each Board committee provides that the committee will, from time to time and to the extent the committee deems appropriate, review risk and compliance matters relevant to the committee and report the results of such review to the full Board. As required by NYSE rules, the charter of the Audit Committee states that the Audit Committee will assist with Board oversight of risk and compliance matters, and in any event will review AvalonBay’s perceived major financial risk exposures and the steps management has taken to monitor and control such exposures. At most regularly scheduled Board meetings, the Board reviews key matters relating to AvalonBay’s finances, liquidity, operations and investment activity. On an annual basis, the Board and/or the Audit Committee engages in a broader discussion about Company-wide risk management. The Audit Committee (and on occasion the full Board in lieu of the Audit Committee) also reviews matters related to cyber security. Although it is not the primary reason the Board’s current leadership structure was implemented, AvalonBay and the Board believe the current leadership structure—including both an Executive Chairman of the Board and a separate Lead Independent Director—helps facilitate these risk oversight functions by providing multiple channels for risk-related concerns and comments.

| AvalonBay Communities | 17 | |

| 2022 PROXY STATEMENT |

Stockholder Engagement and Responsiveness

We consider our relationship with our stockholders to be an important part of AvalonBay’s success and we value the outlook and opinions of our investors. During 2021 and early 2022, our management reached out to stockholders who collectively held a majority of AvalonBay’s outstanding stock, and to stockholder advisory firms, to discuss our practices and policies with respect to environmental, social and governance (“ESG”) issues and other matters. Management spoke with those who responded to that outreach regarding such issues. These discussions addressed matters such as Board composition and refreshment, stockholder rights, the format for executive compensation, and sustainability efforts. The goal of these conversations was to ensure that management and the Board understood and considered the issues that are most important to our stockholders and to enable AvalonBay to address them effectively. The feedback received was conveyed to and discussed with the Nominating, Governance and Corporate Responsibility Committee and the full Board.

In addition to conversations with our stockholders, AvalonBay management occasionally receives and responds to correspondence from stockholders and stockholder advocacy groups and, when appropriate, shares this correspondence with the Nominating, Governance and Corporate Responsibility Committee and the full Board. The Board also considers the votes of stockholders at our Annual Meeting and discusses potential issues raised through that forum.

Board and Committee Self-Evaluation

Each year the Board conducts a self-evaluation in which the Lead Independent Director talks to each director individually regarding his or her view of how the Board overall and each of our directors is performing. Topics discussed may include whether there are additional items that should be added to agendas, whether management is providing the Board with the information it needs to effectively review AvalonBay’s performance and risks, whether meetings feature a healthy level of debate and participation, whether the composition of the Board is appropriate, whether the Board is adequately monitoring AvalonBay’s strategic direction, and the performance and development of management. This feedback is then discussed in an executive session of the Board.

In addition, each of the Board’s committees annually conducts a review of its charter and a self-assessment of the performance of committee duties under its charter over the previous year. The review generally includes:

the role of the committee within AvalonBay,

the committee’s structure and functioning,

the committee’s charter and fulfillment of delegated responsibilities, and

the committee’s follow-through.

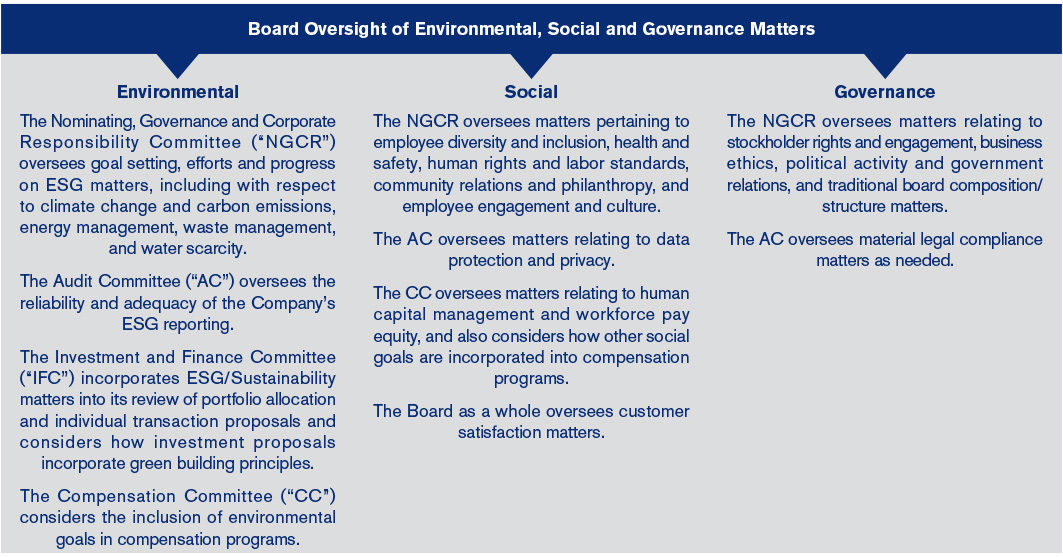

During late 2021 and early 2022, the Board and its committees reviewed the committee charters to ensure there were clearly delineated responsibilities with respect to oversight of ESG matters, and clarifying amendments were made to the charters.

| AvalonBay Communities | 18 | |

| 2022 PROXY STATEMENT |

Committees of the Board of Directors

The Board of Directors has four committees: the Audit Committee, the Compensation Committee, the Nominating, Governance and Corporate Responsibility Committee, and the Investment and Finance Committee. With the exception of the Investment and Finance Committee, the committees are made up entirely of independent directors. The charters for the Audit, Compensation, and Nominating, Governance and Corporate Responsibility Committees are available in the Investor Relations section of our website under “Corporate Governance Documents.”

|

Audit Committee |

||

|

Members: Havner (Chair), Buckelew, Howard, Lieb and Lynch. Meetings in 2021: 8 The Board of Directors has determined that each of Messrs. Havner, Buckelew and Lieb is an “audit committee financial expert” as defined by the Securities and Exchange Commission (“SEC”). In the case of Mr. Havner, this determination was based on his past experience as a Certified Public Accountant and Chief Financial Officer and Chief Executive Officer of a public company. In the case of Mr. Buckelew, this determination was based on his experience as Chief Financial Officer at Princess Cruises, and the fact that the Internal Audit Function of Carnival Cruises had reported to him. For Mr. Lieb, the determination was based on his past experience as Chief Financial Officer of Greenhill & Co. and his experience with Goldman Sachs. The designation of each of Messrs. Havner, Buckelew and Lieb by the Board as an “audit committee financial expert” is not intended to be a representation that they are experts for any particular purpose, nor is it intended to impose on them any duties, obligations or liabilities that are greater than the duties, obligations or liabilities imposed on them as members of the Audit Committee and the Board in the absence of this designation. The Board has determined that all members of the Audit Committee are “independent” and financially literate under the rules of the NYSE. |

|

Responsibilities: The Audit Committee, among other functions, has the sole authority to appoint and replace the independent auditors; is responsible for the compensation and oversight of the work of the independent auditors; reviews the results of the audit engagement with the independent auditors; and reviews and discusses with management and the independent auditors AvalonBay’s quarterly and annual financial statements and major changes in accounting and auditing principles. The Audit Committee also oversees and reviews AvalonBay’s data protection and privacy efforts and meets with senior information technology associates periodically with respect to such matters; oversees material legal compliance matters as needed; reviews the overall enterprise risk management performed by the Board of Directors; and oversees matters pertaining to the reliability and adequacy of the Company’s ESG disclosures.

|

|

Compensation Committee |

||

|

Members: Lieb (Chair), Buckelew, Hills and Walter. Meetings in 2021: 4 The Board of Directors has determined that the members of the Compensation Committee are “independent” under the rules of the NYSE. |

|

Responsibilities: The Compensation Committee, among other functions, reviews, designs and determines management compensation structures, programs and amounts; establishes corporate and management performance goals and objectives; reviews human capital management; and reviews and makes recommendations to the Board of Directors regarding AvalonBay’s incentive compensation plans, including the Second Amended and Restated 2009 Equity Incentive Plan, as amended (the “Equity Incentive Plan”). The Compensation Committee also reviews employment agreements and arrangements with senior officers when the Board determines it is appropriate to have such agreements. In addition, our Equity Incentive Plan provides that the Compensation Committee, in its discretion, may delegate to the Chief Executive Officer all or part of the Committee’s authority to grant awards to individuals who are not subject to the reporting and other provisions of Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), subject to limitations and guidelines set by the Committee from time to time. |

| AvalonBay Communities | 19 | |

| 2022 PROXY STATEMENT |

|

Nominating, Governance and Corporate Responsibility Committee |

||

|

Members: Swanezy (Chair), Aeppel, Brown and Walter. Meetings in 2021: 5 The Board of Directors has determined that the members of the Nominating, Governance and Corporate Responsibility Committee are “independent” under the rules of the NYSE. |

|

Responsibilities: The Nominating, Governance and Corporate Responsibility Committee’s functions include identifying individuals qualified to become Board members; recommending to the full Board each year a slate for nomination for election to the Board; considering policies relating to Board and committee meetings; reviewing and recommending changes to director compensation; recommending the establishment or dissolution of Board committees; and reviewing and considering succession plans with respect to the positions of Chairman of the Board and Chief Executive Officer (including through periodic evaluation and discussion with the Board of internal candidates for such succession). The NGCR also reviews policies and activities in the areas of environmental sustainability, diversity and inclusion, employee engagement and culture, community relations and philanthropy, health and safety, political activity and government relations. |

|

Investment and Finance Committee |

||

|

Members: Brown (Chair), Aeppel, Havner, Hills, Howard, Lynch, Meetings in 2021: 4 |

|

Responsibilities: The Investment and Finance Committee was formed, among other reasons, to review and monitor the acquisition, disposition, development and redevelopment of AvalonBay’s communities. The IFC may also, from time to time, review financial matters, proposals and policies on behalf of the Board. The Investment and Finance Committee has authority, subject to certain limits and guidelines set by the Board of Directors and Maryland law, to approve investment and financing activity. The IFC also incorporates ESG/Sustainability matters into its reviews and considers how investment proposals incorporate green building principals. |

Meetings and Attendance

The Board of Directors met five times during 2021. The Board generally schedules regular executive sessions at each of its meetings during which the independent directors meet without management participation. The independent directors met in executive session five times during 2021.

During 2021, each director attended at least 75% of the total number of meetings of the Board and meetings of the Board committees of which he or she was a member. The Board’s policy is that every director should attend our annual meetings of stockholders. All of the directors attended the virtual 2021 Annual Meeting of Stockholders.

| AvalonBay Communities | 20 | |

| 2022 PROXY STATEMENT |

Governance Documents

The Board has adopted a Code of Business Conduct and Ethics that applies to the Board of Directors and all AvalonBay executives and employees. In addition, the Board has adopted Corporate Governance Guidelines that govern many of its practices and policies. These documents are available on the Investor Relations section of our website (www.avalonbay.com) under “Corporate Governance Documents,” together with the following additional documents:

Charters for each of the Compensation, Audit, and Nominating, Governance and Corporate Responsibility Committees

Director Independence Standards

Policy on Political Contributions and Government Relations

Policy on Recoupment (“clawback”)

Policy Regarding Shareholder Approval of Future Severance Agreements

Policy Regarding Shareholder Rights Agreements

Senior Officer Stock Ownership Guidelines

To the extent required by the rules of the SEC and the NYSE, we will disclose amendments and waivers relating to these documents in the same place on our website. Additional information on corporate governance policies is included in the Compensation Discussion & Analysis section of this proxy statement under the heading “Compensation Policies.” The information contained on, or available through, our website is not incorporated by reference into this proxy statement.

Contacting the Board

Any stockholder or other interested party may contact any of our directors, including the Lead Independent Director or our independent directors as a group, by writing to them at the following address. All communications addressed to one or more directors will be forwarded as addressed.

[Name of Director or Group of Directors]

c/o AvalonBay Communities, Inc.

4040 Wilson Boulevard, Suite 1000

Arlington, VA 22203

Attention: Corporate Secretary

Human Capital Management

As of January 31, 2022, we had 2,927 full-time and part-time employees and 32 temporary employees. Approximately 70% of our associates work on-site at our operating communities and the remainder work on other functions.

We believe an inclusive and diverse mindset at all levels of our organization is critical if we are to succeed in the competition for talent. We believe this company-wide mindset also contributes to a motivated and engaged workforce with a variety of perspectives. To help promote an inclusive culture, we support associate resource groups and opportunities for associates with diverse backgrounds, experiences, and perspectives to connect with one another. Our senior leaders sponsor these networks, but they are managed by associates.

Current associate resource groups include:

Black Associate Coalition;

Women’s Leadership Network;

Latinx Employees of AvalonBay for Diversity;

Associate Rainbow Coalition;

Veteran Outreach Support Committee; and

Parents and Caregivers Group.

We have also offered training in unconscious bias to all associates at the manager level and above, and we have broadened our talent acquisition efforts to incorporate diverse interview slates and panels and incorporate outreach to student groups and associations that represent diverse populations.

In 2020, we announced our Company’s vision to:

increase the representation of women in leadership to a level at parity with the overall presence of women in the relevant workforce by 2025; and

increase under-represented minorities in leadership to 20% by 2025 and to 25% by 2030.

The Company publishes its most recently filed EEO-1 data on its website. The information contained on, or through, our website is not incorporated by reference into this proxy statement.

| AvalonBay Communities | 21 | |

| 2022 PROXY STATEMENT |

As previously announced, we will continue our partnership with the National Urban League, including a $150,000 annual commitment.

Mr. Naughton, AvalonBay’s Chief Executive Officer until 2021, joined the CEO Action for Diversity and Inclusion pledge and the Dividends Through Diversity, Equity & Inclusion (DDEI) CEO Council initiative spearheaded by Nareit. Upon becoming Chief Executive Officer, Mr. Schall also joined both groups.

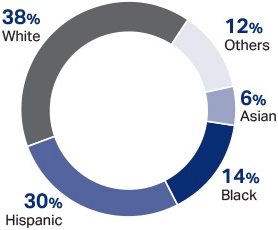

As of January 31, 2022, approximately 39% of our associates (including management and executives) self-identify as female, and the self-reported ethnicity of our associates was as follows:

Others: American Indian/Alaska Native, Native Hawaiian/Other Pacific Islander, two or more races, undeclared and no response.

We recognize that attracting, motivating, developing, and retaining engaged and capable associates is critical to our long-term success. We have several strategies for promoting the professional development and career advancement of our associates, including:

Expecting our managers and associates to have ongoing check-in conversations, and to memorialize those meetings in a year-end performance review.

Offering our associates extensive training, including through our learning management system, AvalonBay University, which offers approximately 900 courses providing technical, safety, management, leadership, ethics, compliance and cyber-awareness instruction.

Assisting associates in career development through instructor-led training, online learning, mentoring opportunities, and a new internal career portal.

Providing a tuition assistance program.

Each year we conduct an Associate Perspective Survey, which enables management to better understand how associates view AvalonBay, their managers, and their overall experience. Based on the survey results, we endeavor to improve in areas identified by associates. For the 2021 survey, we included four engagement questions as well as three open-questions that addressed what associates most appreciate, where they need additional support, and how AvalonBay can continue to provide a safe working environment.

We take workplace safety seriously at our construction sites, our operating communities, and our offices. We monitor project-level safety performance metrics at our construction sites through our Construction Site Safety Observation program and our dedicated safety team. Our maintenance associates are required to take monthly safety training on a variety of subjects, and our risk management group monitors incident reports from our offices and communities. To emphasize the importance of these issues, elements of compensation for our construction group and our Chief Executive Officer are based on safety compliance performance.

The COVID-19 pandemic has presented unique health and safety challenges. We responded by taking a number of actions to promote the well-being of our associates, including permitting remote work and flexible schedules where feasible, providing extended paid leave for associates who needed to miss work for COVID-19-related reasons, establishing office and community safety protocols, conducting training and refresher courses on COVID-19 prevention, and communicating regularly with associates on topics like how to obtain vaccinations.

| AvalonBay Communities | 22 | |

| 2022 PROXY STATEMENT |

Board Oversight of Human Capital

The Board of Directors, through its Compensation Committee, regularly reviews management’s human resources practices, including talent management, succession planning, diversity metrics, and inclusion and diversity efforts. The Board actively supports activities that encourage an inclusive culture at AvalonBay, including in some cases participating in and contributing to programs sponsored by our associate resource groups.

Additional information on each of these areas relating to human capital management can be found in our Corporate Responsibility Report by visiting https://www.avaloncommunities.com/about-us/corporate-responsibility/cr-reports. Materials located on AvalonBay’s website and referenced herein are not deemed to be part of this proxy statement and are not incorporated herein by reference.

Transactions with Related Persons, Promoters and Certain Control Persons

Our Code of Business Conduct and Ethics prohibits employees, including executive officers and directors, from engaging in activities that create a conflict of interest with AvalonBay unless all relevant details have been disclosed and an appropriate waiver permitting the conduct has been received. An activity constitutes a conflict of interest under the Code if (i) the activity could adversely affect or compete with AvalonBay, (ii) any interest, connection or benefit to the employee or director from the activity could reasonably be expected to cause such employee or director to consider anything other than the best interest of AvalonBay when deliberating and voting on Company matters, (iii) any interest, connection or benefit to the employee or director from the activity could give such employee or director or a member of his or her family an improper benefit that was obtained on account of his or her position within AvalonBay, or (iv) the employee or director is placing his or her own interests above the Company’s interest. Waivers for executive officers or directors may only be granted by the Board or a designated committee of the Board, and any waiver granted to an executive officer or director will be disclosed to the extent required by law or NYSE rules. The Nominating, Governance and Corporate Responsibility Committee (or any other committee that is designated) is responsible for administering the Code for executive officers and directors.

| AvalonBay Communities | 23 | |

| 2022 PROXY STATEMENT |

Director Compensation

The compensation for our non-employee directors is described below. Directors who are also employees do not receive additional compensation for serving on the Board. Our Board and Nominating, Governance and Corporate Responsibility Committee periodically assess the total compensation for non-employee directors relative to the compensation provided by similarly sized real estate investment trusts, by our multifamily peer group, and by a group of cross-industry similarly sized companies. Based on the most recent review, the Board has approved increases to the compensation of non-employee directors effective beginning after the 2022 Annual Meeting, as noted in the table below.

|

Type of compensation |

Amount |

New Amount |

|

How and when paid |

||

|

Annual retainer |

$ |

90,000 |

$ |

100,000 |

|

Quarterly installments, in cash, or at the director’s election, in the form of deferred stock |

|

Restricted stock (or, at the director’s election, deferred stock) |

$ |

170,000 |

$ |

175,000 |

|

Granted on the fifth business day following the annual meeting Number of shares determined based on the closing price of AvalonBay’s common stock as reported by the NYSE on the grant date Shares vest in equal quarterly installments over one year |

|

Additional retainer for Audit Committee chair |

$ |

25,000 |

$ |

30,000 |

|

Quarterly installments, in cash, or at the director’s election, in the form of deferred stock |

|

Additional retainer for Compensation Committee chair |

$ |

20,000 |

$ |

25,000 |

|

Quarterly installments, in cash, or at the director’s election, in the form of deferred stock |

|

Additional retainer for chairs of the Investment and Finance Committee and the Nominating, Governance and Corporate Responsibility Committee |

$ |

15,000 |

$ |

20,000 |

|

Quarterly installments, in cash, or at the director’s election, in the form of deferred stock |

|

Additional retainer for Lead Independent Director |

$ |

30,000 |

$ |

35,000 |

|

Quarterly installments, in cash |

All shares of restricted stock (or deferred stock awards) granted to non-employee directors vest in four quarterly installments over a one-year period, subject to accelerated vesting upon departure from the Board except in the case of a voluntary departure by the director during the director’s elected term that is not due to death or disability or the director’s removal for cause. If a director elects to receive a deferred stock award in lieu of restricted stock, the director will receive shares of stock in respect of the vested portion of the deferred stock award within 30 days following termination of service as a director.

Director Stock Ownership Guidelines

Under our Corporate Governance Guidelines, non-employee directors are generally required to hold shares (or deferred stock units) having a value that equals or exceeds five times the annual cash retainer paid to non-employee directors. Directors have five years from the commencement of their service as a director to comply with such requirement. As of April 1, 2022, all the non-employee directors who have served on the Board for five years or more were in compliance with this requirement.

The following table sets forth the compensation for service as an AvalonBay director received by each non-employee director in 2021.

| AvalonBay Communities | 24 | |

| 2022 PROXY STATEMENT |

Director Compensation Table

|

Name |

Fees Earned |

|

|

Stock |

|

Option Awards ($) (d) |

|

Non-Equity |

|

Change in Pension |

|

All

Other |

|

Total |

||||||

|

Glyn F. Aeppel |

|

90,000 |

|

|

169,990 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

259,990 |

|

Terry S. Brown |

|

-- |

|

|

274,862 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

274,862 |

|

Alan B. Buckelew |

|

90,000 |

|

|

169,990 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

259,990 |

|

Ronald L. Havner, Jr. |

|

-- |

|

|

284,986 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

284,986 |

|

Stephen P. Hills |

|

90,000 |

|

|

169,990 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

259,990 |

|

Christopher B. Howard(3) |

|

45,000 |

|

|

169,990 |

|

|

-- |

|

|

-- |

|

|

-- |

|

|

-- |

|

|

214,990 |

|

Richard J. Lieb |

|

110,000 |

|

|

169,990 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

279,990 |

|

Nnenna Lynch(3) |

|

-- |

|

|

215,102 |

|

|

-- |

|

|

-- |

|

|

-- |

|

|

-- |

|

|

215,102 |

|

H. Jay Sarles(4) |

|

45,000 |

|

|

-- |

|

|

-- |

|

|

-- |

|

|

-- |

|

|

-- |

|

|

45,000 |

|

Susan Swanezy |

|

-- |

|

|

274,862 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

274,862 |

|

W. Edward Walter |

|

120,000 |

|

|

169,990 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

289,990 |

|

(1)

The amounts in the table above include the following cash fees paid in 2021: |

||||||||||||||||||||

|

Name |

Annual Retainer ($) |

Committee Chair Fee ($) |

Lead Director Fee ($) |

Total Payment ($) |

|

Glyn F. Aeppel |

90,000 |

— |

— |

90,000 |

|

Alan B. Buckelew |

90,000 |

— |

— |

90,000 |

|

Stephen P. Hills |

90,000 |

— |

— |

90,000 |

|

Christopher B. Howard |

45,000 |

-- |

|

45,000 |

|

Richard J. Lieb |

90,000 |

20,000 |

— |

110,000 |

|

H. Jay Sarles |

45,000 |

-- |

-- |

45,000 |

|

W. Edward Walter |

90,000 |

-- |

30,000 |

120,000 |

|

(2)

The amounts in column (c) reflect the grant date fair value of the shares of restricted stock or deferred stock units granted to each director. For Messrs. Brown and Havner and Ms. Swanezy, the amount also includes elections to receive deferred stock units in lieu of cash payments totaling $90,000 for each director. For Ms. Lynch, the amount totaled $45,000 as she was elected to the Board in May 2021. This column also includes payment for service as Committee Chairpersons during 2021 as follows: Mr. Brown - $15,000, Mr. Havner - $25,000 and Ms. Swanezy - $15,000. As of December 31, 2021, non-employee directors held the following number of unvested shares of restricted stock and/or deferred stock units: |

|

Director |

|

|

Unvested Restricted Stock |

Unvested Deferred Stock Units |

|

Glyn F. Aeppel |

|

|

— |

425 |

|

Terry S. Brown |

|

|

— |

425 |

|

Alan B. Buckelew |

|

|

417 |

— |

|

Ronald L. Havner, Jr. |

|

|

— |

425 |

|

Stephen P. Hills |

|

|

— |

425 |

|

Christopher B. Howard |

|

|

-- |

425 |

|

Richard J. Lieb |

|

|

417 |

— |

|

Nnenna Lynch |

|

|

-- |

425 |

|

Susan Swanezy |

|

|

— |

425 |

|

W. Edward Walter |

|

|

— |

425 |

Mr. Howard and Ms. Lynch were elected to the Board at the May 2021 Annual Meeting of Stockholders.

Mr. Sarles did not stand for re-election at the May 2021 Annual Meeting of Stockholders and served during 2021 only through May 20, 2021.

| AvalonBay Communities | 25 | |

| 2022 PROXY STATEMENT |

Proposal 2. Non-Binding, Advisory Vote on Executive Compensation

The Compensation Discussion and Analysis as presented below describes AvalonBay’s executive officer compensation program and decisions made by the Compensation Committee and the Board of Directors with respect to the 2021 compensation of our named executive officers. We believe the compensation program achieves our goals of (i) attracting, motivating and retaining experienced and effective executives, (ii) directing the performance of those executives with clearly defined goals and measures of achievement, and (iii) aligning the interests of management with the interests of our stockholders.

Our Board currently intends for AvalonBay to hold a non-binding advisory vote on executive compensation (known as a say-on-pay vote) every year until the 2023 Annual Meeting of Stockholders. At that meeting we will hold an advisory vote regarding the frequency of future say-on-pay votes.

While the vote on the following resolution is advisory and will not bind us to take any particular action, our Board of Directors will carefully consider the stockholder say-on-pay vote in making future decisions regarding our compensation program. The Board of Directors is asking stockholders to adopt the following resolution:

“RESOLVED, that the compensation paid to AvalonBay’s Named Executive Officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and any related material disclosed in this Proxy Statement, is hereby APPROVED, on a non-binding, advisory basis, by the stockholders of AvalonBay.”

Required Vote and Recommendation

Only holders of record of AvalonBay’s common stock as of the close of business on the Record Date are entitled to vote on this proposal. Proxies will be voted for adoption of the resolution approving the compensation disclosed unless contrary instructions are set forth on the proxy card. A majority of the votes cast on the proposal at the Annual Meeting is required to provide non-binding, advisory approval of the compensation paid to AvalonBay’s named executive officers. Under Maryland law, abstentions and broker non-votes are not treated as votes cast. Accordingly, an abstention or broker non-vote will have no effect on the result of the vote.

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE RESOLUTION TO APPROVE, ON A NON-BINDING, ADVISORY BASIS, THE COMPENSATION PAID TO AVALONBAY’S NAMED EXECUTIVE OFFICERS. |

| AvalonBay Communities | 26 | |

| 2022 PROXY STATEMENT |

Compensation Discussion and Analysis

| AvalonBay Communities | 27 | |

| 2022 PROXY STATEMENT |

This Compensation Discussion and Analysis (“CD&A”) describes how the Board of Directors, the Compensation Committee and the Company think about compensation for the Company’s executive officers and what decisions were made in setting 2021 compensation, including how we established goals and aligned compensation with performance and stockholder interests.

Specifically, the CD&A describes the compensation of the following individuals, who were our named executive officers (“NEOs”) in 2021:

|

|

Name |

Title |

|

|

|

Timothy J. Naughton |

Chairman and Chief Executive Officer |

|

|

|

Benjamin W. Schall |

President |

|

|

|

Kevin P. O’Shea |

Chief Financial Officer |

|

|

|

Matthew H. Birenbaum |

Chief Investment Officer |

|

|

|

Sean J. Breslin |

Chief Operating Officer |

|

Consistent with a previously announced planned transition, Mr. Naughton retired as CEO on January 3, 2022 and transitioned to the role of Executive Chairman on that date. Mr. Schall, our President, was appointed to the additional role of CEO effective January 3, 2022, reporting directly to the full Board of Directors.

Executive Summary

Our Company Performance

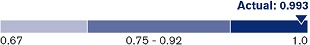

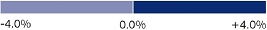

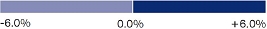

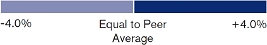

The Company’s performance was impacted by the pandemic and related economic conditions and regulatory responses. In particular, Core Funds from Operations (“Core FFO”) per share declined by 4.9% in 2021 from 2020; however, apartment market fundamentals improved significantly throughout 2021, and we delivered an increase in Core FFO growth per share and Same Store Residential rental revenue in the fourth quarter 2021 as compared to the same period of 2020. Our one-year and three-year annualized total shareholder returns were 62.2% and 17.1% respectively. During 2021, we successfully ramped up our investment activity with almost $2 billion of new development starts and acquisitions funded primarily by dispositions and incremental debt financing at a historically low cost of capital. We also made investments in technology and innovation with a view to providing future value to prospects and residents, and enabling greater operating efficiencies and new sources of revenue. Finally, we continued our emphasis on ESG matters, which are of increasing importance for our residents, employees and stockholders, and we maintained our focus on fostering an inclusive and diverse culture that attracts, retains and provides growth opportunities to our employees.

| AvalonBay Communities | 28 | |

| 2022 PROXY STATEMENT |

|

2021 KEY HIGHLIGHTS |

|

|

Operating Activity We continued our development, testing and implementation of various operating initiatives designed to serve our customers and help grow our revenue streams, including initiatives such as community-wide Wi-Fi, amenity space usage for non-residents, prospect website improvements, smart home access, and mobile maintenance applications. |

CONTINUED DEVELOPMENT AND IMPLEMENTATION OF OPERATING INITIATIVES |

|

Development Activity We completed nine new development communities containing 2,752 apartment homes for an aggregate total capitalized cost of $1.1 billion. We also started the development of 10 new apartment communities which in total are expected to contain 3,010 apartment homes when completed for an aggregate projected total capitalized cost of $1.2 billion. |

$ 1.1B TOTAL DEVELOPMENT COMPLETIONS |

|